Customer 360 — What, Why & How? [2024]

![Banner image of Profisee blog with the title: "Customer 360 ? What, Why & How? [2024]".](https://profisee.com/wp-content/uploads/2023/05/Skyscraper-Customer360_Featured.jpg)

Updated: August 2, 2024

Today, organizations are accumulating exponentially larger volumes of customer data, and it often becomes fragmented, duplicated, inconsistent, incomplete, ungoverned and out-of-date as it travels throughout the organization.

Factor that across the potentially thousands of customer records (and not to mention the scores of touchpoints with each customer) and it’s easy to see why companies have trouble answering seemingly basic questions like:

- Who are my most profitable customers?

- Where do I have up- and cross-sell opportunities with existing accounts?

- Which of my marketing efforts are driving increased purchasing behavior?

- How can I improve customer service?

To answer these questions, organizations are increasingly turning to the notion of a Customer 360 to help comprehensively identify and understand their customers to increase revenue, reduce costs, identify inefficiencies and improve the customer experience.

Download your copy of the comprehensive guide to keep in your back pocket. Or if you’re ready to dive in, continue reading below.

What is a Customer 360?

Customer 360 is the concept of having all your customer data in one place. However, it can have different (and oftentimes conflicting) definitions depending on who you ask.

Some vendors, customers, publications and analysts consider a Customer 360 to be a hub containing all their customer data. Others view it as the primary domain of some data management tools like a master data management (MDM) system or data warehouse. Some people say it is one or the other of these things but enriched with external data — like social media profiles, employer information and more.

It can be difficult to determine which data to include in a Customer 360 view because of the marketing hype that vendors use to sell products. As such, some claim it requires customer interactions. Others maintain it involves transactional data, while some say it simply requires static data — like customer demographic data or master data in one place.

Others also claim that Customer 360s must import or integrate with external data sources, i.e., Dun & Bradstreet for financial services companies. There are also Customer 360 proponents selling the idea that it involves all the above – insinuating that solutions with just some of these capabilities are not sufficient.

Most importantly, Customer 360 platforms only offer a part of the solution in that nearly all real-world business challenges involve both customer data and other business information like the products they buy, locations they visit or campaigns they engage with.

While a Customer 360 vendor may claim that their platform can master over 100 customer attributes, it will not truly add business value if a user cannot analyze those in the context of the 25 product attributes their customers actually interact with.

Rather than approaching each of these data categories, or domains, individually or sequentially, it is important to view them holistically and consider how they together make up the 360-degree view of a customer. Using MDM to understand these domains together will exponentially add more business value than adding another siloed application that only works with a subset of data.

Which Channels Are Involved With a Customer 360?

Channel visibility is another key consideration for implementing Customer 360. Today, many companies have an omnichannel approach to customer sales and communications, further compounding the amount of customer data they need to manage.

Customer channels can include:

- In-person at a company-owned, brick-and-mortar location

- Phone order through sales affiliate or partner

- Online through a company website or mobile app

Regardless of what communication channels your customers use, it is imperative to understand who they are and how they interact with your business. For example, Domino’s Pizza should know it’s the same customer interacting with them whether he or she does so via a mobile application, Domino’s website, a phone call or in the cloud — even across different retail locations.

This example hits at the core of why it is important to thoughtfully consider which data is included in a Customer 360 view. Whichever data is involved must provide this visibility to the enterprise, so customers get the same experience no matter how they interact with the organization. In this case, Domino’s needs to quickly aggregate data across these transactional sources to understand the factors that impact their customer relationships and determine which channels they can use to improve their customer service.

Common Customer Data Problems Solved With a 360 Customer View

Multi-channel communication only works when there’s consistency in the underlying customer data and how it is managed. It is difficult to provide that consistency when there’s often inconsistent data about the same customer spread across several IT systems — each of which may include data for every customer communication channel. True Customer 360s provide that consistency regardless of how many sources are involved.

Another widespread problem that Customer 360 views can help solve is related to customer data quality. Oftentimes, the same customer’s name (or address, phone number, etc.) is represented differently in disparate systems — or even within the same system. For example, John Doe might be spelled in several ways like Jonathan Doe, Jon Doe, Johnny Doe or some other variation. Street addresses might be spelled out or abbreviated; phone numbers could include dashes and hyphens (or not). Each of these points of distinction makes it difficult to tell whether the person in one system is the same in another, and your business applications like CRM and ERP systems often do little to enforce consistency within their customer data.

Customer 360s attempt to resolve this issue so users can identify which person or business constitutes a customer entity and includes their attributes for informed interactions with them. Without it, leveraging third-party external sources like Dun & Bradstreet or social media data becomes difficult because there is no standardization for how customer records are represented.

How a Customer 360 Benefits Your Business

Having a comprehensive, 360-degree view of your customers and your interactions with them has economic, “offensive” benefits like increased revenues with better cross-selling and up-selling opportunities. They also support better customer experience for more personalized marketing experiences – driving higher conversion rates and higher revenues. Additionally, a 360-degree customer view boosts retention rates and helps you understand customer profitability across varying products and services so you can intelligently segment your customers according to meaningful data and trends.

Creating a customer 360 also has innumerable “defensive” benefits that reduce the risk of issuing unfavorable credit terms and regulatory non-compliance — especially with new customer privacy regulations that require organizations to secure personal data and provide it to customers upon request — while helping with general risk management, a critical benefit for financial service firms.

The Challenges of Implementing a Customer 360

The biggest challenges for implementing a Customer 360 are fragmentation and inconsistency of master data. This data is often stored in different warehouses and across disparate systems and does not follow the same format or share the same dimensions or definitions.

This is largely due to inconsistent governance and data structures within and across sources like marketing and sales tools, Customer Relationship Management (CRM) platforms and Customer Data Platforms (CDPs), which each have different ways of representing information. Therefore, there is often a lack of comprehensive insight across source systems, no single version of the truth and an inability to adapt to business conditions and market forces.

These situations make it hard to overcome customer data quality problems to compare sources for the same record. Customer records contain missing, overlapping, conflicting, outdated and inaccurate information that must be resolved to achieve trusted and reliable data. You can fix some of these issues with automation, but others temporarily (or permanently) require human efforts for data stewardship to address contradictory information. These errors can also compound your issues with analyzing other data domains when trying to identify customers and understand their product purchase history or other associated information.

Why Should You Care About a Customer 360?

There are many reasons you should care about a Customer 360, with the significant cost of mishandling data sitting at the top of the list. Improperly managed customer data directly results in missed sales and marketing opportunities and makes it exceedingly difficult to manage regulatory compliance about how consumer data must be managed.

Several regulations have emerged in this area with costly penalties for non-compliance, and more are on the horizon. Current examples of this include the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), both of which aim to give individuals control over their personal data while mandating that controllers and processors of personal data, i.e., your organization, put the appropriate technical measures to implement specific data-protection principles.

Companies can put their reputation and goodwill on the line when they poorly manage customer data. As an example, if a customer service representative does not know whether they are speaking to a customer even after they have identified themselves — or perhaps doesn’t know which products or services the customer has — companies create risk through the poor customer experience that is caused by low-quality customer data.

Additionally, the increasingly distributed, diverse data landscape and the broadening IT infrastructure for business apps make it impossible not to care about a Customer 360 view as this has caused customer data to be more decentralized than ever before and has made it extremely difficult to preserve customer data quality. This creates a need to better manage absolute customer data quality (where fields are missing or incorrectly populated with information) and relative customer data quality (where fields are complete, but the information is represented in different forms with potentially different meanings and cannot be reconciled across systems).

Implementing a Customer 360 has several benefits, but it is also important to consider all the things you cannot do without it, like properly understanding the demand for things like products, services and supplies. You also cannot do accurate sentiment analysis, which is critical for understanding just what customers are saying about your company as well as your products and services.

Most of all, you cannot benefit from modern technologies like machine learning (ML) and artificial intelligence (AI). These tools are great for providing real-time recommendations, customer micro-segmentation, targeted marketing offers and more. But their high data volumes amplify the old “garbage in, garbage out” problem to problematic proportions. If you have poor customer data quality, your training data will create faulty models. If you feed good models poor-quality data, you will get the wrong results. Businesses are looking to monetize these technologies and empower their employees, but without the right data foundation, AI and ML can easily mislead them – wasting resources and increasing costs. Moreover, it may be difficult or virtually impossible to accurately conduct a root-cause analysis — even when recognizable issues arise, and most real-world business issues are not immediately recognizable.

Customer master data management interacts with these technologies in two ways. It enables and supports them by standardizing data for them, effectively de-risking your data. Effective MDM also uses machine learning for intelligently matching and grouping similar records, helping data stewards by learning from their actions (i.e., how to match and resolve conflicting information) and suggesting those actions in the future to accelerate processes.

Why Do I Need a Customer 360 View?

A Customer 360 view can be considered the cost of entry for satisfying, maintaining and increasing your customer base. It gives you a set of universal benefits while also helping solve problems specific to industries like manufacturing, finance and retail. Regardless of your industry or vertical, you need a 360-degree customer view to optimize the customer experience.

By understanding your profit margins by industry, account and even individual customer, you can identify which of your customers are underperforming and work to increase your gross margins. Understanding this helps to more accurately segment customers accordingly to reduce risk and maximize profitability.

By increasing your understanding of who your customers are, a Customer 360 view also enables you to boost retention rates. That understanding is critical for improving revenue generation with relevant cross-selling and up-selling opportunities and increasing your marketing conversation rates by reaching the right customer with the right message at the right time. For instance, understanding its customers better empowers Domino’s to reduce marketing spending by cutting down on duplicate direct-mail campaigns.

Other universal benefits include increased agility to adapt to business and economic conditions. By quickly showing companies all relevant information about their customers, Customer 360 views enable companies to react to situations like the COVID-19 pandemic through means of reducing costs while still leveraging the most meaningful customer interaction channels. Customer 360 capabilities are also extremely important to ensure accuracy in your analytics tools and reporting by giving you the right data for customer data analytics and business intelligence tools.

How Do I Get a 360 Customer View?

Considering these numerous benefits, it is understandable why organizations have been seeking a comprehensive view of their customers. But for all the various approaches, vendors, technologies and resources put toward achieving this objective, companies often have trouble with realizing success for several reasons.

One of the main reasons for failure to implement a Customer 360 is a lack of measurable business goals and implementation roadmap, which relates to the previously mentioned “I’ll know it when I see it” fallacy. Without defining a way to gauge the success of this solution, two things frequently derail these projects. The first is that companies will not actually get started because they lack a clear endgame. The second is they suffer from “scope creep” that encompasses several use cases and becomes far too impractical to ever achieve.

Another disconnect between aspiration and reality for achieving a Customer 360 view can be attributed to lofty sales pitches from CDP and Customer 360 vendors. Since many of them cannot achieve the full scope of MDM, they end up offering subsets of their Customer 360 utility as if they are the real thing. This leads to confusion about what this solution is and is not supposed to do while contributing to wasted funding and even more failed implementation attempts.

The good news is it is relatively straightforward to classify some of the misleading claims that different vendors are selling about Customer 360 solutions. There are a few specific solutions routinely offered as Customer 360s, but each of them only has a few of the features that MDM brings to the table for this particular use case.

Customer Data Platform (CDP)

There is a huge gap between perception and reality when it comes to CDPs. What often happens is that people project expectations onto these solutions that are far beyond the scope and functionality of a CDP. A Customer Data Platform is not technically a platform; it is an application with connectors to the major marketing databases you can use for campaigns. They let you aggregate data across these sources and use it with your customer master data, transactions and interactions while enabling analytics for downstream applications like targeted marketing campaigns.

Although CDPs may be good enough for building marketing profiles, they are inappropriate for customer service and customer data management. They have few means of ensuring customer data quality for core use cases like determining if people are or are not the same or if they actually did something, like redeeming a free trial. There are even fewer capabilities for matching, de-duplicating and supporting data stewardship, which are critical in arriving at a single source of truth that is available across all enterprise systems and data warehouses.

Moreover, the power of linking and grouping — identifying relationships between entities outside of contracts or business, like familial relationships or attorney-client relations — also is not supported by Customer Data Platforms. Significantly, most CDP vendors do not even claim to do any of these things that are important for establishing comprehensive customer views. Compared to MDM, they are also notoriously difficult to perform customer data integration with business applications and customer data analytics platforms.

Conventional Customer Relationship Management (CRM)

Traditional CRM is designed to administer customer or prospect interactions for sales. Like Salesforce Customer 360, these applications do not offer either customer data management or data governance, resulting in serious technical debt, and should not be considered the de facto systems of record for customer data. This takes the form of suspect customer data quality, duplications and a general lack of trust in data — resulting in issues like sales and marketing teams repeatedly contacting the same targets because they cannot check multiple applications for the best email address based on business functions.

The other drawback is you are unable to match or use this data with other sources in real-time, making it hard to issue relevant recommendations across sources with machine learning. This option also lacks support for grouping or matching.

Augmented Data Catalogs

Augmented data catalogs are the newcomers on the block; they couple metadata management with more extensive customer data management capabilities. Because they are relatively new offerings, they cannot match MDM’s exhaustive data management functionality like matching, merging and enforcing survivorship rules to create a trusted golden record. Additionally, multi-domain MDM provides excellent metadata management control through creating a metadata domain — without the need for additional, stand-alone software.

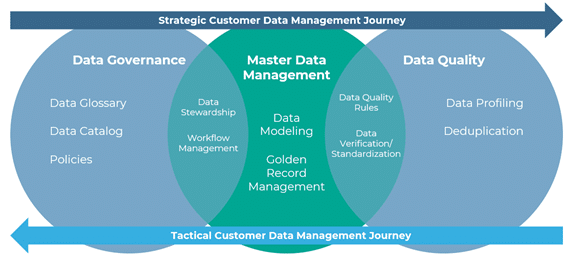

Master Data Management

The only way to truly achieve a Customer 360 view is to tackle the customer MDM challenge at its core. The above applications realize they cannot match MDM’s core integrated capabilities of data modeling, customer data integration and customer data quality, which is why they market subsets of these functional capabilities while claiming to be Customer 360s. Nevertheless, there are significant differences in MDM capabilities for Customer 360s that are important to be aware of.

The core advantage of using MDM to achieve a Customer (or product or location) 360 is that it is a comprehensive platform approach rather than an individual application approach to data management.

While an application-centric approach may seem appealing at first, it often takes as long or even longer to implement than MDM and is much more restrictive overall especially if the MDM platform had starter solution templates. These templates allow organizations to implement MDM quickly without the domain-specific limitations of the application model.

Some MDM vendors have also responded to market noise about Customer 360 by taking a ‘360-application’ approach to delivering MDM.

While this may initially seem appealing — as it appears to offer a pre-built application for a given domain — this is most often not the case, as pre-built applications must be modified to fit the specifications of the business, legacy data sources and use case in question. MDM platforms can serve as customer data hubs, a centralized repository of customer information from which multiple applications and downstream systems can pull the most accurate and timely information. In harmonizing data across disparate systems, MDM can sync the master golden record to the source systems, so every application and data source has access to the same clean, trusted data (a benefit often missing from application-based ‘360’ approaches).

It is important to know there are even MDM vendors that sell Customer 360 applications that they claim are multidomain solutions. But what they often mean is that they offer several single-domain, application-centric solutions under the guise of MDM. Even if this approach is sold by MDM vendors, it still has the core limitations of the application-based approach in that multiple domains are not mastered in the same environment.

How to Build a Customer 360 Dashboard

An important piece of many Customer 360 initiatives is having dashboards that visualize information and important metrics about customers. Dashboards make it easy to spot trends at a glance and get a quick overview of how much money customers are spending, whether or not they’re happy, whether it looks like they will churn and more.

The process of building a Customer 360 dashboard will vary from organization to organization, but in general, it looks like this:

- Identify Data Sources and Integrate Data: Determine which data you want or need to use in your dashboard and identify the source systems for that data. Common sources include systems like CRM, CDP and ERP. From there, integrate the data using an MDM tool like Profisee to integrate the data and get it all in one place.

- Use MDM to Clean and Standardize the Data: With your data in a central repository, it’s time to make it usable by downstream systems or a data product like your Customer 360 dashboard. For example, with Profisee, you would define a data model for your customer master data and configure the system to enforce your data governance policies. Next, clean and standardize your data to match and merge similar records, remove duplicate records, optionally enrich them with third-party data and standardize them according to your data governance rules – that way your Customer 360 dashboard is an accurate representation of your customers’ purchase history and behavior and won’t lead to incorrect conclusions..

- Connect Your MDM Tool to a Business Intelligence Solution: Now that your data is usable, you can load it into a business intelligence (BI) or analytics solution by connecting it to your MDM tool. For example, using Profisee’s native integrations with the Microsoft ecosystem, you can connect Profisee to Microsoft Power BI or Microsoft Fabric to start building the dashboard – though Profisee data can also be easily configured as a data source and visualized in other tools like Tableau and Qlik.

- Design Your Dashboard: Determine which metrics about your customers are important to include in your dashboard. Commonly used metrics include customer churn rate, customer lifetime value and satisfaction scores, but you may want to include others depending on your situation. Next, query the data you loaded into your BI tool for those metrics and create visualizations for them using elements like graphs, charts and tables. Some commonly used visualizations include gauge charts, scorecards, line graphs, scatterplots, box-and-whisker plots and tables, but you should choose the visualizations that best serve the purposes of your dashboard.

- Publish Your Dashboard and Set the Refresh Rate: When you’re happy with the way your dashboard looks, it’s time to hit publish. Many BI solutions will let you create a shareable link or embed code that you can share with relevant stakeholders or embed on a website or portal, like SharePoint. Finally, adjust your report settings to refresh at the rate you need (daily, weekly, monthly) so that people using the dashboard see results based on data from the correct time frame.

Master Data Management: Beyond Customer 360

The challenges above are often harder to address when using a CDP for Customer 360s. It may be better than doing nothing — but with its limited data-quality capabilities and inherent lack of multi-domain functionality, will a CDP truly solve the whole Customer 360 problem, or will it simply limit your future growth? Although they are an interesting proposition, CDP platforms ultimately will not resolve the above challenges, produce the above benefits and solve common data problems Customer 360s should. Top-tier MDM, however, will.

Perhaps the most important aspect of Customer 360 that is missing is the vital need for a multi-domain context. Nearly all real-world business use cases require the mastering of multiple domains to deliver a solution — so any Customer 360 is only a part of the solution.

Master Data Management: Customer 360, Product 360 and More

No domain exists in a vacuum; the others provide necessary context on how your company should handle customers. For instance, financial services companies should know where customers purchased products, what channels were used, their payment history and other factors like their risk scores and claims history for a comprehensive, 360-degree view of them.

Combining this information across domains enables an insurance company to assess risk across the entire customer journey. It provides this benefit to banks, credit unions and FinServ/FinTech players, too.

Multi-domain MDM excels in providing multi-domain insight that simply is not possible with a CDP. As you begin to address real-world business problems, you will notice that no problem only encompasses a single domain — and quickly see this is one of the primary weaknesses of using a Customer Data Platform. Manufacturing companies, for example, must understand their customers’ products, procurement information, suppliers and vendors, types of equipment used, locations and various warehouse supplies to effectively serve them. CDPs cannot deliver this multi-domain functionality.

Customer 360, then, is just a piece of the puzzle when it comes to managing your company’s data estate and leveraging it as a source of competitive advantage. While your immediate problem may include the lack of a unified customer view and the inherent challenges that come with that — like knowing your most profitable customer — you will need to manage your product, supplier, asset or location data. And you need a platform that can scale up with your needs.

Choosing the Right Master Data Management Solution

Rather than a one-time fix, you need a trusted partner along your journey to building a trusted foundation of key enterprise data. And implementing MDM is not just a technological problem. In many cases, organizations require fundamental changes to their business process to maintain clean master data, and some of the most difficult MDM issues are more organizational than technical.

Once you identify the need for MDM software, you need to determine the best solution for your organization. But that in and of itself can be an overwhelming task, especially given the number of MDM solutions available today.

To help you along this process, take a look at 35 of the best MDM tools on the market today and compare them based on numerous factors such as strengths and weaknesses.

Regardless of the solution you choose, you will need to justify your investment and gain buy-in from stakeholders throughout your organization. It is no surprise that according to Gartner, the No. 1 reason that an MDM program fails is the lack of a structured framework to qualify and quantify the value that data management creates for the organization.

Because of this, Profisee has developed what is called a Business Impact Roadmap, or BIR, to help put our customers on the path to a successful MDM implementation and journey. It starts with a compelling business case that:

- Clearly describes the business opportunity.

- Helps prioritize initiatives and resources.

- Identifies key performance indicators.

- Quantifies a projected return on investment.

For more information about choosing and evaluating MDM solutions, visit the Profisee MDM resource hub.

CUSTOMER 360 resources

There are many resources out there where you can learn more about realizing a 360° view of the customer. Read our full guide on the what, why and how of your customer 360.

Benjamin Bourgeois

Ben Bourgeois is the Head of Product and Customer Marketing at Profisee, where he leads the strategy for market positioning, messaging and go-to-market execution. He oversees a team of senior product marketing leaders responsible for competitive intelligence, analyst relations, sales enablement and product launches. He has experience managing teams across the B2B SaaS, healthcare, global energy and manufacturing industries.