Master Data Management (MDM) For Banking and Finance

Build trusted analytics, delight your customers and reduce risk with master data management (MDM).

POOR-QUALITY DATA IS A RISK YOU CAN’T AFFORD

With inaccurate, inconsistent or outdated master data, financial services organizations face increased risks derived from poor data including…

Incomplete view

of the customer

Non-compliance with

regulatory requirements

Failure to detect

fraudulent activity

Stalled product and/or

service innovation

Delayed integration of

mergers and acquisitions

Operational

inefficiencies

…and more!

Leverage Data as a Strategic Asset

Profisee MDM can help financial services organizations with…

MDM USE CASES BY INDUSTRY

Consumer Finance

“How do I achieve a better understanding of my customers, their financial history and how they operate?”

How Profisee Helps

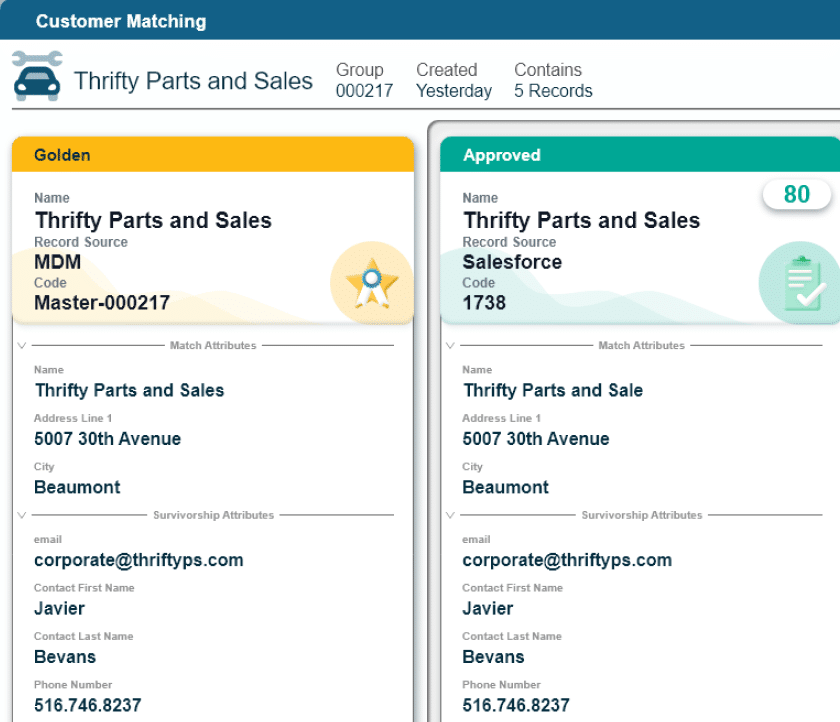

Create a centralized 360-degree customer view that enhances sales opportunities while improving the customer experience.

Credit Unions/Banking

“How do I know I have the full picture of a customer’s credit profile and potential risk before extending additional credit?”

How Profisee Helps

Integrate and consolidate disparate data sources into a single view and enrich enterprise data with third-party services and householding information for a complete understanding of credit risk.

Insurance

“How do I more efficiently manage claims and policies to better inform and advise my customers?”

How Profisee Helps

Acquire accurate, consistent policy attributes and claims records to identify fraudulent claims, reduce errors, track claim status and manage policy lifecycles.

Financial Services

“How do I more effectively cross-sell and up-sell my products and services to the right customers?”

How Profisee Helps

Build a complete, accurate, 360-degree view of your customers with MDM serving as a solution for the financial services industry.

Uncover New Applications for MDM in Financial Services

Accelerate statutory reporting and reduce errors with Profisee MDM, enabling faster compliance and more reliable data for regulatory needs.

Effectively cross-sell and up-sell services to complex customers – spanning investment banking, retail banking, commercial banking, private wealth, and other services.

Streamline KYC processes and improve AML compliance with centralized, governed customer data, reducing risk and operational inefficiencies.

Measurable Results from our Financial Services Customers

Relevant Resources for Financial Services

The Importance of Data Governance for Digital Transformation in Financial Services

Learn More

MDM and the CDO: Twin Superpowers for Business Transformation

Learn More

Optimizing Financial Services with Master Data Management

Learn More

Data & Address Verification

Learn More![Banner image of Profisee blog with the title: "Customer 360 ? What, Why & How? [2024]".](https://profisee.com/wp-content/uploads/2023/05/Skyscraper-Customer360_Featured.jpg)

Customer 360 — What, Why & How? [2024]

Learn More

Credit Unions: How to Get a True Customer 360 View

Learn MoreLearn How Customers Increased Business Value with Profisee

Streamlining Agency Onboarding

Learn how ICW Group used Profisee to create a centralized hub for agency information and improve onboarding by eliminating duplicate data and attaining a complete view of the agency.

Targeting Revenue Opportunities

Learn how Hancock Whitney used Profisee to master customer records and implement trusted data into their operation systems to improve their marketing strategy and create a 360-degree customer view.

Enriching Customer Relationships

Learn how First Horizon used Profisee to simplify customer onboarding and eliminate duplicate data and entry errors creating advanced connections with their customers.

Specialty Insurance Carrier

Thousands of Hours Saved

See how this insurer achieved a 5.6x boost in broker onboarding efficiency and saved 3,000 hours of manual data work.Master Data Management (MDM) for Financial Services FAQS

Master Data Management (MDM) financial services plays a vital role in the banking sector, supporting various use cases that enhance data governance and operational efficiency. One significant application is Governed Underwriting Control Code Data, where MDM ensures that control code data is accurate and compliant. This enhances decision-making during the underwriting process, allowing banks to mitigate risks effectively.

Another important MDM use case in banking is Agility in Statutory Management Reporting. MDM helps streamline the reporting process, ensuring that financial institutions can meet statutory requirements efficiently while maintaining data accuracy and compliance.

MDM in banking industry also supports banks in efforts to Grow Share of Wallet by providing a comprehensive view of customer data. This enables financial institutions to identify cross-selling and upselling opportunities, ultimately driving revenue growth.

MDM also plays a crucial role in Streamline KYC & AML Compliance. By integrating and managing customer data effectively, banks can enhance their Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, reducing the risk of regulatory penalties.

Implementing MDM in financial services brings a multitude of benefits that can transform operations and enhance customer satisfaction. One of the primary benefits is Improved Data Quality. MDM helps ensure that data is accurate, consistent, and reliable by eliminating duplicates and correcting errors. This not only reduces mistakes in reporting but also enhances overall decision-making processes.

Another significant advantage is Increased Operational Efficiency. By breaking down data silos and streamlining processes, MDM reduces redundancy and fosters collaboration among departments. This efficiency leads to faster response times and improved workflow.

MDM also plays a critical role in enhancing the Customer Experience. With a single, accurate view of customer data, financial institutions can deliver personalized services that meet individual customer needs, fostering loyalty and retention.

Finally, MDM aids in Regulatory Compliance. By maintaining accurate and accessible data records, financial institutions can ensure compliance with various regulations, mitigating the risk of fines and legal issues.

These benefits have been validated by leaders in the banking industry as well. For example, banks with advanced data capabilities are more likely to achieve better profitability. According to McKinsey’s Global Banking Annual Review 2023, over half of banks globally are earning less than the cost of equity, but those investing in data infrastructure, such as Master Data Management, can unlock growth and profitability. In 2022, the return on equity for some banks reached a 14-year high, driven in part by data-driven strategies to optimize margins and capital management. Integrating MDM helps financial institutions ensure data quality and consistency across their operations, leading to smarter decision-making and growth opportunities.

In the banking sector, master data refers to the critical business information that serves as the foundation for operations and strategic decision-making. This encompasses several key MDM banking categories:

| Type of Master Data | Common Attributes | Benefits of Managing It |

|---|---|---|

| Customer Data | Personal information (name, address, contact details), account details (account numbers, types, balances), transaction history | Provides a unified view of customers, enhancing personalization and service, improves customer relationship management, enhances compliance with regulations like KYC and AML. |

| Account Data | Product details (loans, mortgages, credit cards), features and benefits, pricing information | Ensures accurate tracking and management of financial products, facilitates better risk management and reporting, improves operational efficiency and decision-making. |

| Product Data | Standardized data elements (currency codes, regulatory classifications), definitions and classifications (risk categories, product categories) | Streamlines product offerings and ensures consistency across channels, enhances customer understanding and satisfaction with financial products, supports effective marketing and sales strategies. |

| Reference Data | Standardized data elements (currency codes, regulatory classifications), definitions and classifications (risk categories, product categories) | Ensures compliance and reduces errors in transactions and reporting, supports data consistency across systems and departments. |

MDM addresses several challenges commonly faced by financial services, ultimately enhancing operational effectiveness and compliance. One significant challenge is the existence of Data Silos. MDM in financial services effectively integrates data from disparate systems, allowing various departments to access consistent and accurate information. This integration fosters better collaboration and informed decision-making.

Another critical challenge MDM solves is Data Quality Issues. Financial institutions often grapple with inaccurate or incomplete data, leading to mistakes in reporting and analytics. By standardizing data and implementing validation processes, MDM enhances data quality and reliability, resulting in more accurate insights.

Additionally, MDM helps mitigate Compliance Risks. In an industry heavily regulated by governmental and financial authorities, maintaining compliance is paramount. MDM ensures that data is accurate, complete, and easily auditable, which simplifies the compliance process and reduces the risk of penalties.

According to a 2022 Forrester report, financial services firms that prioritize data governance and compliance through solutions like MDM reduce risks associated with regulatory non-compliance, which is critical as the sector faces increasingly stringent regulations on data privacy and financial reporting. Effective MDM supports Know Your Customer (KYC) and Anti-Money Laundering (AML) processes by providing accurate, consolidated data across systems, which can streamline compliance and avoid costly penalties.

Finally, MDM significantly improves Customer Relationship Management. By providing a unified view of customer data, banks can better manage relationships and tailor services to meet individual customer needs. This personalized approach fosters customer loyalty and enhances the overall customer experience.

See how the Profisee platform delivers a complete view of trusted,

high-quality data for financial services organizations.