How well do you know your customers?

There are now approximately 125 million credit union memberships in the United States, which is equal to 33% of the total U.S. population. People are congregating to Credit Unions, not only for the higher rates on savings accounts but for their recognized hands-on and personalized approach to customer service.

For banking, mobile platforms are becoming more prevalent and central to the customer experience. According to the American Bankers Association, around 73% of Americas most frequently access their bank accounts via mobile platforms or online.

Credit Union memberships growing at a consistent pace year after year and new customer touchpoints gaining in popularity indicate only one thing – Credit Unions are awash in data.

Connecting all this data is a herculean challenge.

Why Connect Your Customer Data?

For example, the department managing checking and savings accounts might know John Doe, but the mortgage department might not because they have different information on John Doe or cannot easily see which products John Doe has enrolled in at the Credit Union.

John Doe might be married to Jane Smith, but because Jane chose not to take John’s last name, they may be defined as two different households in the database.

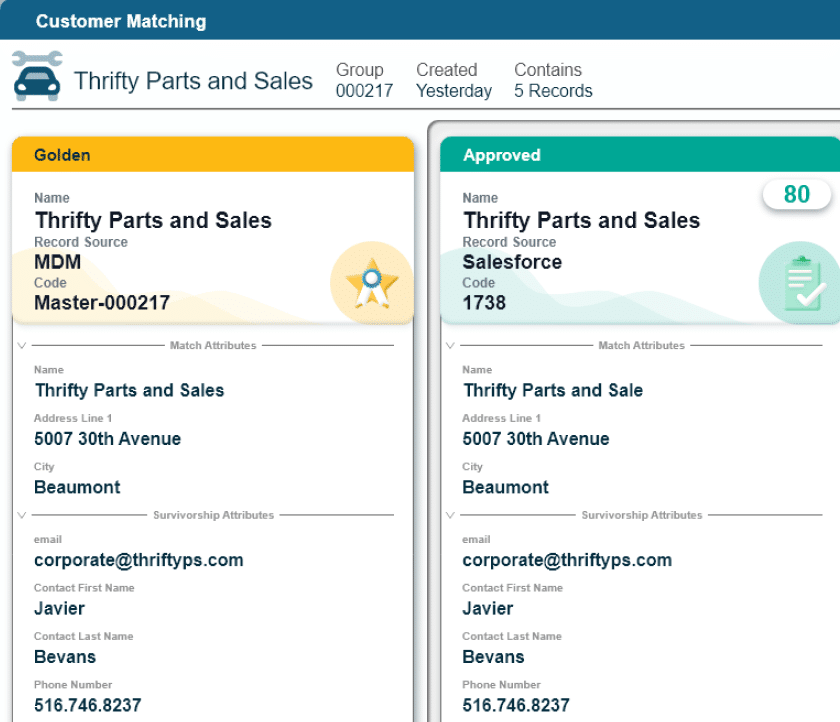

These disconnections can cause a ripple effect that can significantly impact Credit Unions’ ability to cross-sell and upsell or even scale for growth. Core transactional systems do not do a good job of locating and defining one specific customer. Without a golden record of who each customer is, Credit Unions cannot achieve the complete view needed to succeed.

Customer 360

For a true Customer 360 data experience, where Credit Unions know what a household is buying, who belongs to a household, and more; Credit Unions must clean, merge, and gather all their data from each of their systems.

This is made possible through Master Data Management (MDM). The goal of MDM is to act as a Rosetta Stone between companies’ siloed databases. MDM helps systems not only speak the same language but define who John Doe and Jane Smith truly are.

Stitching together customer data with MDM enables a completely transparent view of possible risks associated with each customer and how to facilitate more effective product engagement.

With MDM, Credit Unions can effectively grow their book of business, while maintaining good loss ratios, and without a doubt, answer the question around how well they know their customers with confidence and ease.

Are you interested in diving into the details? Learn how you can unlock a customer 360 for credit unions.