Table of Contents

Updated February 27, 2025

As a data leader, there is no better feeling professionally than seeing your enterprise grow and succeed. There is a certain satisfaction that comes with locking down a new customer, closing that next big deal and providing buyers with exactly what they need.

The only problem is all of these aspects of your business and more hinge entirely on your enterprise’s data quality.

According to Gartner, poor data quality costs organizations an average of $12.9 million every year. Bad data is the biggest detriment to launching your strategic initiatives and achieving your business goals.

What is Bad Data?

Like a brick wall, bad data can stand between you and your most strategic business initiatives. Whether it’s a long-delayed digital transformation, a complicated post-merger integration or a disruptive new cross-selling campaign, poor-quality data can stifle innovation and lead to missed opportunities.

Fortunately, you are not alone. Many organizations are suffering the same issues that come with poor data quality because they often share common root causes of poor data quality:

- Accruing “technical debt” as individual departments and business units adopt their own CRMs, ERPs or other source systems

- Since each source system is purpose-built for a specific use case, many are not interoperable with other applications and require manual data preparation or continual clean-up to analyze their output in aggregate

- Data can be input by different employees, automatically imported in batch from other systems or entered by customers or other stakeholders in web portals — and typos, inconsistent data formats or technical errors can grow exponentially over time

Before venturing out to solve your data quality issues with master data management or another tool, it is important to familiarize yourself with the different types of bad data and understand the biggest ways that low-quality or bad data can harm a business from the inside out.

Bad Data Types

There are four widely accepted attributes of data quality. They are:

- Uniqueness: Uniqueness refers to the lack of duplication in any given record or field. Measuring uniqueness requires that rules which establish the definitions for any record or field must be documented.

- Accuracy: Accuracy of data speaks for itself but also requires that rules which define when data is accurate (or inaccurate), must also be established.

- Timeliness: Timeliness refers to the “freshness” of data, where data may otherwise be accurate but so outdated that it’s irrelevant or meaningless to the business.

- Completeness: Completeness is ensuring all key attributes of a given record are included in that record.

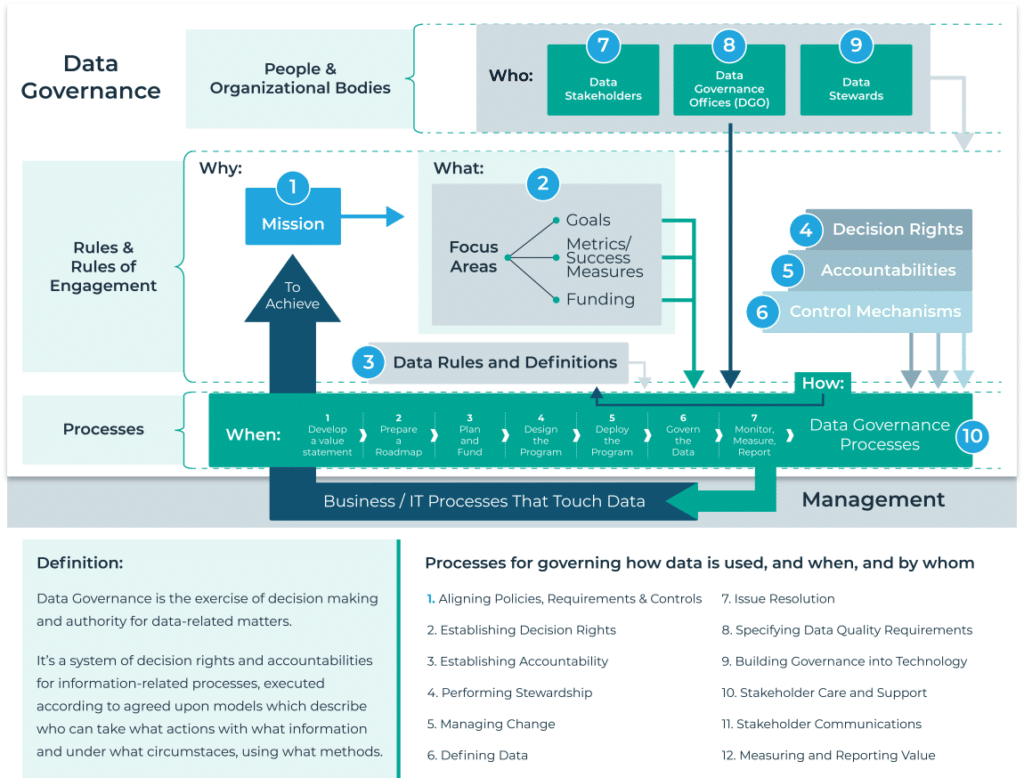

Defining when data is “bad” requires that rules be documented. This allows data managers to assess when data meets the expected quality standards or when data fails those standards.

Tools like MDM and data quality allow these rules to be assessed automatically and enforced consistently over time. When data fails to adhere to these documented rules — which are often created by data governance councils — it could be considered bad.

Examples of Bad Data

Examples of the four types of bad data I mentioned above can be found everywhere in a business, in both analytical and operational systems.

It’s quite common for customer records in a CRM system to routinely fail all four measures of data quality, often because that customer data is duplicated, incomplete or inaccurate. The same is true with other operational systems, like ERP systems, where data referring to your suppliers, your assets or your products often fails tests for data quality.

The same is true with more analytical systems. Here, it’s quite common for bad data to infiltrate reporting databases and systems — generally because the system being used to create the reports is completely unaware there are any problems with the data, particularly when it comes to data accuracy.

Many of us will encounter examples of this in our normal everyday lives. How often have you received the same marketing offer — often from a credit card company — where it’s obvious there are two slightly different versions of your personal data triggering these duplicated (and highly costly) marketing events?

Sometimes the problems of bad data can have disastrous downstream impacts. This is particularly the case when the data is being consumed by AI-based solutions. A newsworthy example of this was the Air Canada case, where the airline lost a major court battle related to inaccurate data being provided by its online AI chat agent — data that had not recently been checked for accuracy.

How Does Bad Data Arise?

There are many reasons why bad data is created in any organization. Here are just a few of them:

- Human error

- Lack of enforcement of data quality standards in key business systems

- Lack of organizational alignment to defined quality standards

- No data quality standards to begin with

- Lack of integration across business systems or processes

- Data quality requirements that differ between analytical and operational systems

- Quality standards are overly rigid and do not recognize that the standards can vary by use case

Bad data can arise because of simple mistakes, but it can also be created because of misalignment between the expectations of data and analytics teams and the expectations of data and analytics teams — especially when it comes to data being “fit for purpose.”

Often, data may meet minimum quality standards for operational purposes, like executing a contract or handling a customer support inquiry. But quality standards may be higher when applied to analytical processes, like creating a customer 360 report.

How Does Poor Data Quality Negatively Impact My Business?

1. Bad Decision-Making

Poor data quality can have significant negative impacts on decision-making at a company in several ways:

Inaccurate or incomplete information

When data quality is poor, the data can be inaccurate, incomplete, or inconsistent. This can lead decision-makers to draw incorrect conclusions or make faulty assumptions based on the data, which can result in poor decisions.

Misleading insights

Poor data quality can lead to misleading insights, which can create false trends and patterns that can skew decision-making. This can be particularly dangerous when the insights are used to make strategic decisions, long-term plans or extending credit to a customer or business.

Increased risk

Poor data quality can increase the risk of making poor decisions. For example, if a company relies on poor-quality data to make decisions about financial investments or customer behavior, they may end up making poor investments or missing opportunities to improve customer satisfaction.

2. Reduced Efficiency/Productivity (and Ultimately Profitability)

Poor data quality can lead to inefficient business operations and lost profits in several ways:

Duplicated Efforts

Poor data quality can result in duplicated efforts and rework, as employees may need to spend additional time cleaning and correcting data. This can lead to decreased productivity, increased costs, and longer lead times to complete tasks, which can ultimately affect the company’s bottom line.

Missed Opportunities

Poor data quality can lead to missed opportunities to optimize business operations and increase profits. For example, if a company’s data quality is poor, they may miss out on identifying trends or patterns that could lead to new revenue streams or operational efficiencies.

Misallocation of Resources

Poor data quality can lead to misallocation of resources, such as assigning resources to the wrong projects or initiatives. This can result in wasted resources, lost profits, and decreased overall efficiency.

Poor Decision-making

Poor data quality can also lead to poor decision-making, which can negatively impact business operations and result in lost profits. For example, if a company relies on poor-quality data to make decisions about inventory or pricing, they may end up with excess inventory or pricing that is too low, resulting in lost profits.

Overall, poor data quality can lead to significant negative impacts on business operations and profitability. Therefore, it is essential for companies to invest in data quality management to ensure that the data they use for decision-making and business operations is accurate, complete, and consistent. By doing so, companies can optimize their operations, increase efficiency and maximize profits.

3. Diminished Customer Satisfaction and Retention

Poor data quality can have a significant negative impact on the customer experience in several ways:

Inaccurate or incomplete customer information

If a company’s customer data is inaccurate or incomplete, it can lead to poor customer service experiences. For example, if a customer’s contact information is incorrect, the company may not be able to reach them when necessary or may send communication to the wrong address, leading to frustration and dissatisfaction.

Inconsistent communication

Poor data quality can also lead to inconsistent communication with customers. For example, if a company sends multiple emails to the same customer with different information, it can cause confusion and frustration for the customer.

Missed opportunities

Poor data quality can lead to missed opportunities to provide personalized and targeted experiences to customers. For example, if a company’s data shows that a customer frequently purchases a certain product, but the data is not up-to-date, the company may miss the opportunity to provide targeted marketing or special promotions for that product, leading to lost sales.

Decreased trust

Customers rely on companies to keep their personal information safe and secure. If a company’s data quality is poor, it can lead to breaches or other security issues, which can erode trust and damage the customer experience.

Satisfying and retaining customers and/or clientele drives revenue opportunities. This requires a comprehensive, 360-degree view of your customers and the ability to conduct customer-driven analytics. If you cannot anticipate consumer demand, then you leave them unsatisfied which lowers your odds of retention. The last thing you want to do is lose a loyal, long-time customer.

A major source of revenue is cross-selling or upselling your existing customer base. Today, customers expect personalized experiences based on their browsing history and unique interests.

Overall, poor data quality can lead to negative impacts on the customer experience, which can damage a company’s reputation and lead to lost business. Therefore, it is crucial for companies to invest in data quality management to ensure that the customer data they collect and use is accurate, complete, and up-to-date.

4. Increased Business Risks

Poor data quality can increase business risk in several ways:

Compliance risk

Poor data quality can lead to compliance risk if a company is unable to meet regulatory requirements, such as GDPR or HIPAA, due to incomplete or inaccurate data. This can result in fines, legal action or reputational damage.

Operational risk

Poor data quality can increase operational risk, such as the risk of system errors or data breaches. For example, if a company’s data quality is poor, it can lead to inaccurate financial reporting or customer data breaches, which can have severe consequences on the company’s operations and reputation.

Financial risk

Poor data quality can increase financial risk by leading to poor decision-making or inaccurate financial reporting. For example, if a company relies on poor-quality data to make investment decisions or pricing strategies, they may end up making poor investments or pricing that is too high or too low, resulting in lost profits.

Reputation risk

Poor data quality can also increase reputation risk by leading to negative customer experiences or public scrutiny. For example, if a company’s data quality is poor and leads to inaccurate billing or shipping information, it can lead to customer complaints and negative online reviews, which can damage the company’s reputation.

Overall, poor data quality can increase business risk in several ways, which can have severe consequences on a company’s operations, reputation and bottom line. Therefore, it is crucial for companies to invest in data quality management to ensure that the data they collect and use is accurate, complete, and up-to-date. By doing so, companies can mitigate business risks and operate more efficiently and effectively.

How Do I Fix Bad Data?

You’ve likely heard the common phrase, “Modern problems require modern solutions.” This exact principle can be applied to your data estate. These days, it is crucial for your business to be truly data-driven. This requires a data management solution that provides your organization with the enterprise-wide data necessary for growing your business.

Master data management (MDM) resolves data quality issues at its core to deliver high-quality, trusted data for your entire organization. It cleans and harmonizes your disparate data across multiple systems while eliminating silos, duplicates and inconsistencies along the way. The best part is, it seamlessly integrates with your system(s) while still keeping you in control of your multidomain data.

The bottom line is if your data isn’t managed, then you cannot deliver value for your business. There is no use in leveraging bad data. This modern approach to data management breaks through that brick wall holding you back so that you can finally reach your business objectives. Now you can make strategic decisions and deliver value to your business with accurate reporting and analytics.

DATA INSIGHTS,

DIRECT TO YOUR INBOX

How Can I Maintain Data Quality Long-Term?

When watching your favorite sporting event, there are often rules set in place to keep it fun, fair and engaging. Without rules, it would be chaotic, disorganized and unrefined. For this reason, you need to define the rules and standards of your enterprise-wide data estate. To preserve the quality of your critical data, you need to implement data governance policies throughout your organization.

According to a survey from the Harvard Business Review, 60 percent of company executives believe they are under-investing in their enterprise data strategy. As startling as this number may appear, this percentage would be significantly lower if more organizations understood the importance of integrating data governance procedures. By administering these rules and regulations, you standardize your enterprise data and define what data quality means for your business.

But like that favorite sporting event, you need to have a referee to enforce those rules and keep the game running smoothly. This is where MDM comes into play, serving as that “referee” for your data’s rules, standards and conventions. By managing an organization’s critical data assets, MDM enables businesses to view and manage their data in a centralized and standardized manner.

Break through the brick wall of bad data

How Profisee Helps Your Data Quality

Profisee MDM provides a faster and easier approach to master data management. The integrative platform deploys in as little as 90 days to support your digital transformation in months, not years. Plus, it serves as a cloud-native solution meaning it seamlessly integrates with the Microsoft applications you already have allowing you to run your data and not the other way around.

It’s time to fix the data quality issues standing in the way of your success. Watch an on-demand demo today and see for yourself how Profisee MDM can help deliver value for your business!

Malcolm Hawker

Malcolm Hawker is a former Gartner analyst and the Chief Data Officer at Profisee. Follow him on LinkedIn.