Master Data Management (MDM) for Insurance

Simplify underwriting and claims processing, respond with agility to changing business environments and streamline claims management with Profisee Master Data Management.

Driving Insurance Innovation with Trusted Data

With Profisee, overcome complex data challenges and automate cumbersome manual processes to transform the way you manage risk, rate and underwrite new policies, process claims and more.

Optimize underwriting:

Better data quality leads to faster and more accurate risk assessment for underwriting, and powerful workflow automation features reduce tedious manual data processes.

Personalize customer experiences:

Create comprehensive 360-degree views of your customers to build more targeted marketing campaigns — and tailor-fit insurance products to better serve your customers.

Streamline claims management:

Build robust workflows to automate claims reviews and approvals while maintaining human oversight for records and attributes flagged for manual review.

Bolster risk management:

Aggregate, govern and standardize data from across departments and business units for better anomaly detection to stop insurance fraud in its tracks.

Maintain regulatory compliance:

Enhance ESG reporting:

Uncover and track data related to ESG goals for better goal setting and progress reports. Provide important context with built-in reference data management.

Insurance Master Data Management Use Cases

Customers

“How can Profisee help us personalize offerings to our customers?”

How Profisee Helps

With Profisee, you can aggregate data about your customers from any source to build customer 360 views that can help you personalize coverage offerings, make better product recommendations and proactively reach out to customers who need help. Customer 360 is the driving force behind some of the most successful cross-sell and up-sell programs, and MDM is a key enabler for achieving true customer 360.

Policies

“How can Profisee help us set more competitive rates for our policies?”

How Profisee Helps

It’s much easier to assess a policyholder’s risk when you have high-quality, trustworthy data. Profisee lets you aggregate data about the people, places and things for which you provide coverage, merge duplicate records to keep only the most accurate, up-to-date information and then make it accessible to the downstream systems you use for determining risk and setting rates. With a fuller picture of the data and a better understanding of the risk landscape, insurance providers can offer more personalized policies with better premiums.

Compliance

“How can Profisee help us maintain regulatory compliance?”

How Profisee Helps

Regulations can vary drastically depending on location — especially in the US, where most insurance regulations are set on a state-by-state basis. Profisee makes it easy to manage your location data, letting you integrate data from systems like ERP, agency management, accounting and compliance management to provide you with a centralized view of the regulatory landscape across all your locations. This not only helps you minimize noncompliance events, but it also helps improve reporting and auditability by maintaining more accurate edit history for records.

Efficiency

“How can Profisee help us improve operational efficiency?”

How Profisee Helps

If you can diagram it, you can automate it. Profisee comes with powerful workflow automation and data workflow orchestration features to help you automate repetitive tasks and reduce manual effort. If you have similar processes across different domains, Profisee’s Workflow Templates let you define a process once and configure it across data domains.

Uncover New Applications for MDM in Insurance

Improve underwriting processes by enhancing data accuracy and governance, leading to better risk assessments and streamlined compliance.

Reduce the complexity and cost of systems data consolidation by ensuring data accuracy and governance throughout the migration process.

The realization of accretive earnings requires rapidly understanding the acquired business by the acquiring company’s own metrics & KPIs and also requires getting wholistic visibility into the combined operations.

Insurance MDM Frequently Asked Questions

What is insurance master data management?

Insurance master data management refers to managing the specific types of master data (data domains) relevant to insurance companies. While MDM tools are used much the same way for insurance companies as companies in other industries, insurance MDM deals with industry-specific challenges and use cases, like governance of control data and code values for underwriting and process automation for claims processing.

How is MDM useful for insurance?

Insurance companies use master data management for a variety of reasons, including policy rating, risk management, underwriting, compliance and claims processing. MDM lets insurance companies break down data silos between agencies and systems to create accurate, up-to-date, unique and standardized records that can be used for enterprise analytics, customer 360, process automation and AI enablement. Insurance companies use MDM for all these endeavors and more to boost sales, reduce incidents of non-compliance and lower costs stemming from inefficient operations and risky underwriting.

What does MDM look like in insurance?

Depending on a company’s goals and use cases, MDM can look quite different across insurance companies. One insurance company may, for example, decide to implement MDM for an operational use case to make its claims management process more efficient. This could temporarily disrupt business operations since it will most likely require changes to existing processes, but if the company deems the potential gains from speeding up claims management worth the disruption, it may decide to proceed anyway.

A different insurance company may decide to start where many organizations start when they first implement MDM — with an analytical use case. One example of this might be generating better analytics for risk assessment to improve decision making around the way certain policies are drafted. Analytical use cases are usually considered an easier place to start with MDM because analytical use cases typically don’t disrupt business operations and deliver faster time to value.

For instance, with access to a unified view of high-quality data from across the enterprise, a provider of homeowner’s insurance may discover that it’s been overestimating the potential risk of water damage to homes in a certain region and underestimating the risk of trees falling due to strong wind. Such a discovery can impact the way policies are rated, which could lead to premiums being too high or low.

How does insurance MDM work?

Once an insurance company has determined a first use case for implementing MDM and decided on an implementation style or data architecture, insurance MDM typically works like this:

- Relevant data systems of record are identified and integrations are set up with the MDM tool

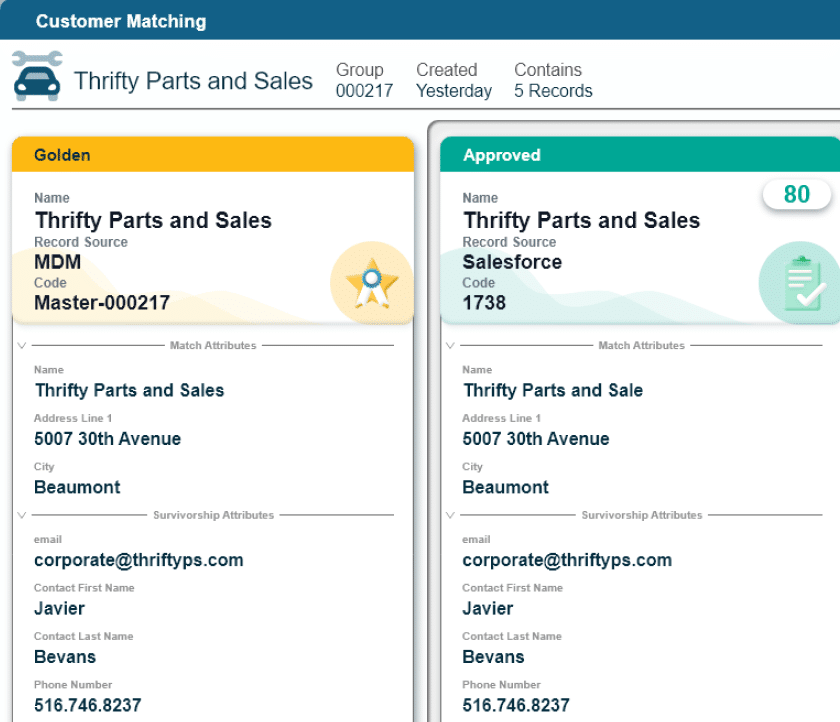

- The MDM tool aggregates data from systems of record where it is then cleansed, deduplicated and standardized according to the company’s data governance policies to create golden records

- Depending on whether the company implements analytical or operational MDM, the newly created golden records are then either made accessible to downstream systems like analytics or they are pushed back to systems of record to support and enhance business operations

Remember, this is one general example. Other insurance companies may decide to start using the MDM tool itself as the system of record to create all new data records and then push those records to the relevant systems that used to create them. A company’s size, number of records to manage and strategic goals all have big impacts on the way insurance MDM works, but most companies operate according to some version of the process outlined above.

Discover how the Profisee platform helps build and ensure a

trusted foundation of insurance data.